Learn about Transmission Services Corporation including our News & Press Releases and Executive Team.

Talk to us

Have questions? Reach out to us directly.

Learn about Transmission Services Corporation including our News & Press Releases and Executive Team.

About Us

- Miles of transmission lines owned and operated

- More than 5,200

- Bond Ratings

- A1/A/A+

- Bonds Outstanding

- $2.34 billion

This is the investor website for the Lower Colorado River Authority (LCRA). For bondholder convenience, we have created separate sites for two different debt programs: the Lower Colorado River Authority debt program and the LCRA Transmission Services Corporation debt program. Please use the drop-down menu for details for each debt program.

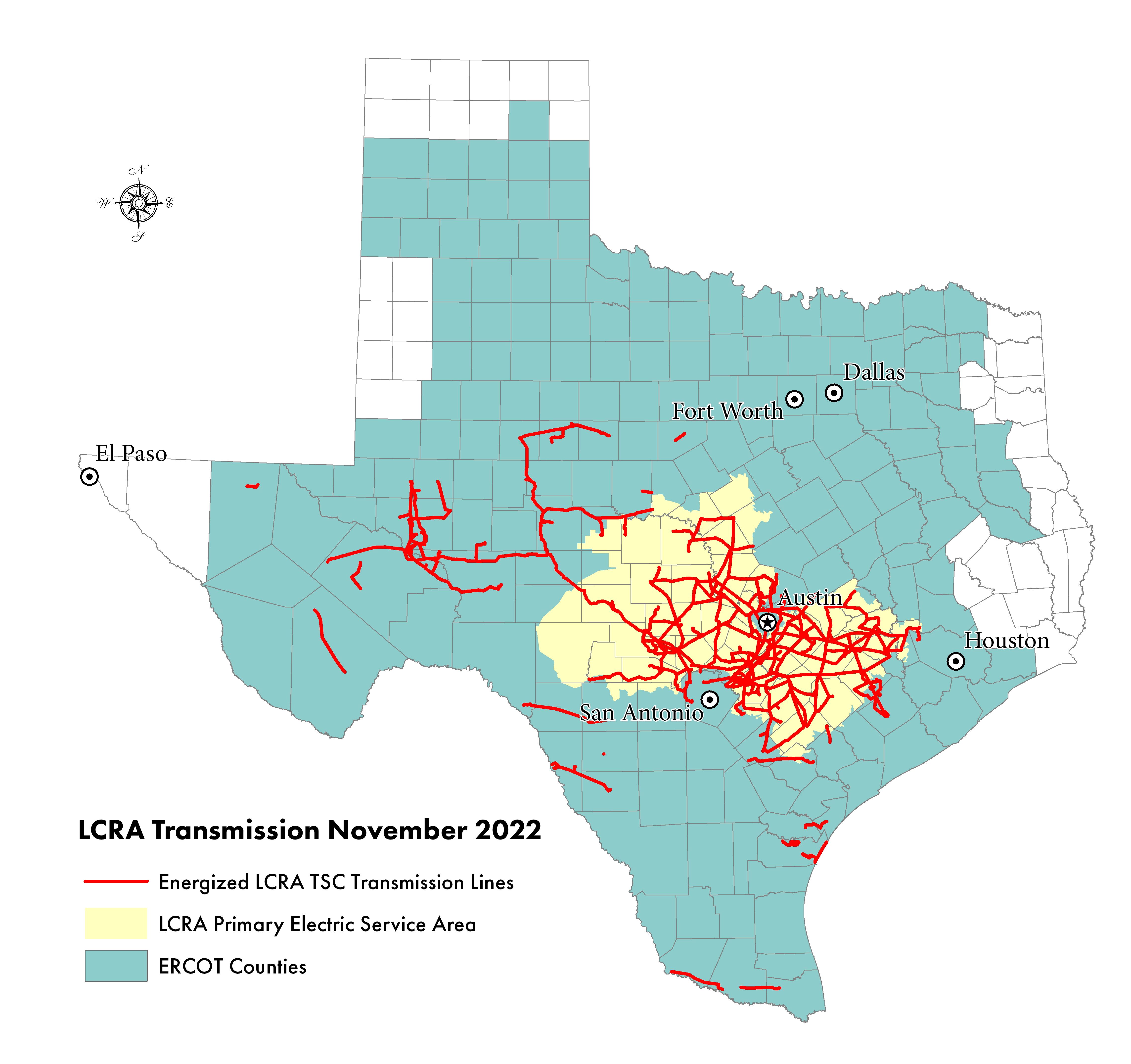

LCRA TSC is a nonprofit corporation created by LCRA to act on LCRA’s behalf pursuant to Chapter 152, Texas Water Code, as amended, to conduct LCRA’s electric transmission business. On Jan. 1, 2002, LCRA transferred ownership of its transmission facilities to LCRA TSC to satisfy the state’s requirements.LCRA TSC owns and operates all of the electric transmission and transformation assets previously owned by LCRA as well as transmission and transformation assets constructed and financed by LCRA TSC or acquired by LCRA TSC with other available funds. LCRA personnel, including primarily those that operate LCRA’s transmission department, are responsible for performing all of LCRA TSC’s activities pursuant to a services agreement between LCRA TSC and LCRA. Since its creation, LCRA TSC has invested more than $2.4 billion in transmission projects to meet the growing demand for electricity, improve reliability, connect new generating capacity, address congestion problems that affect the competitive market and help move renewable energy to the market. LCRA TSC plans to invest about $1.2 billion over the next five years to build new transmission facilities and improve existing ones.

Image Gallery

News

LCRA to invest about $1.63 billion in capital projects over the next year to support Texas during period of unprecedented challenges, opportunities

May 21, 2025

AUSTIN, Texas – The LCRA Board of Directors on Wednesday approved a business plan of $591.4 million and authorized capital investments of about $1.63 billion for energy, water and public service projects to support Texas in fiscal year 2026.

The Lower Colorado River Authority is the primary wholesale provider of electricity in Central Texas and manages the lower Colorado River and six Highland Lakes. LCRA Transmission Services Corporation is one of the largest electric transmission service providers in Texas.

“Our business and capital plans outline how LCRA plans to meet the tremendous growth in Texas and tackle the unprecedented challenges and opportunities that come with it,” said Stephen F. Cooper, chair of the Board of Directors. “LCRA is proud to serve our growing region by proactively anticipating and responding to growth.”

Capital projects include power generation and infrastructure improvement, dam rehabilitation, and water supply projects, as well as projects for LCRA’s park system. As one of the largest public power providers in the state, LCRA provides power for electric cooperatives and small towns in Central Texas by selling wholesale electricity through long-term contracts with retail utilities.

LCRA is helping meet the increasing need for reliable, dispatchable power in Texas by building two electric generating units at LCRA’s natural gas-fired peaker Timmerman Power Plant in Caldwell County. The first unit is expected to be online later this year.

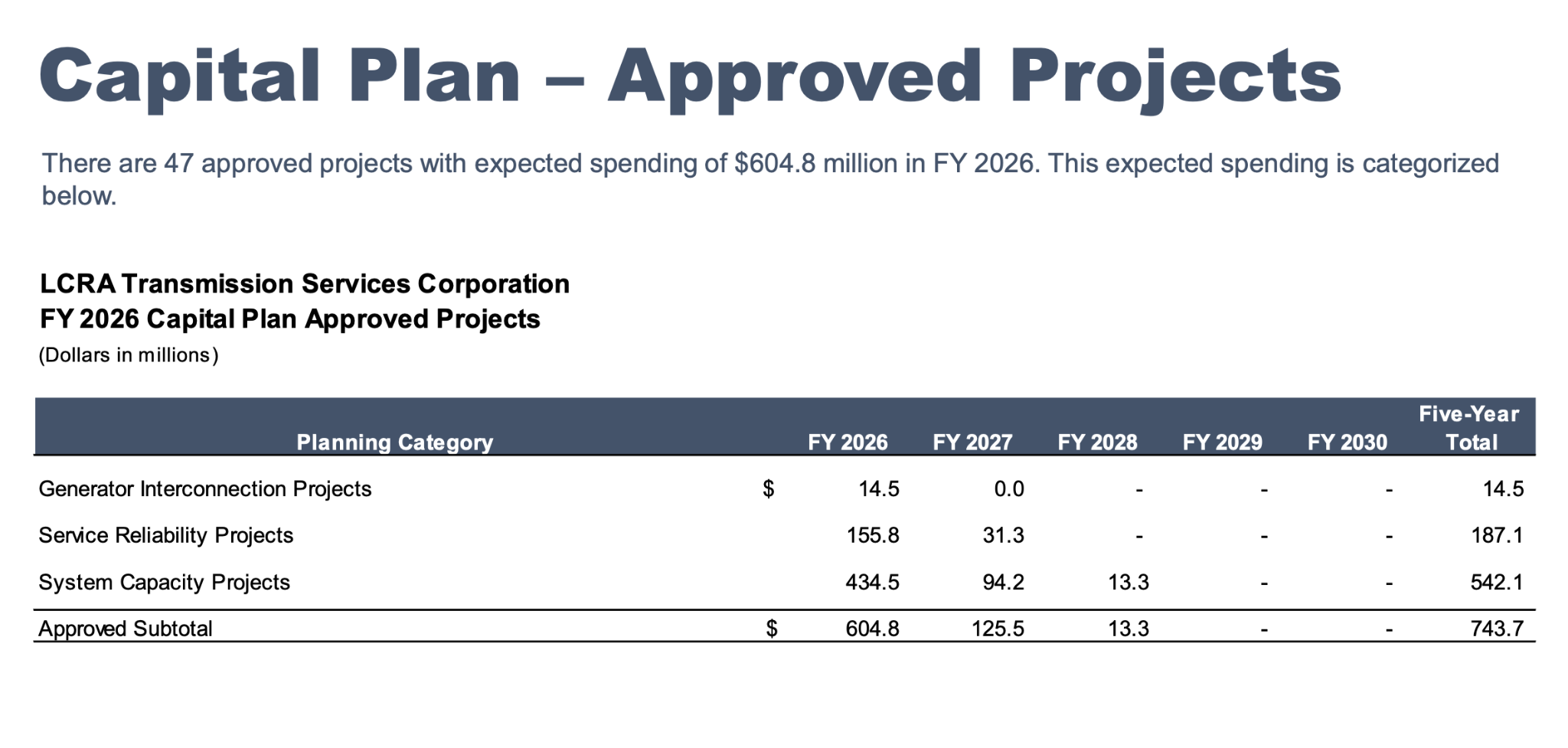

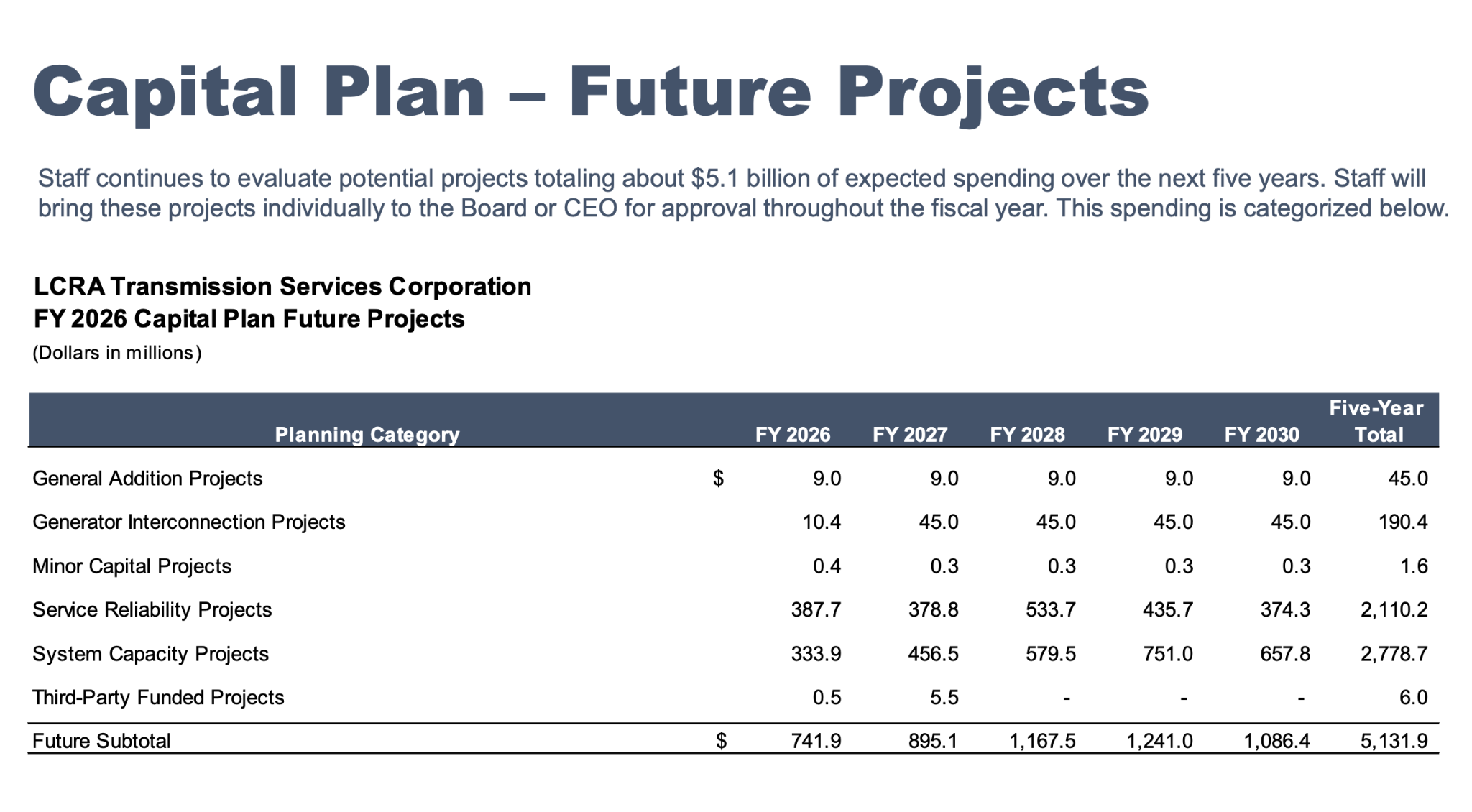

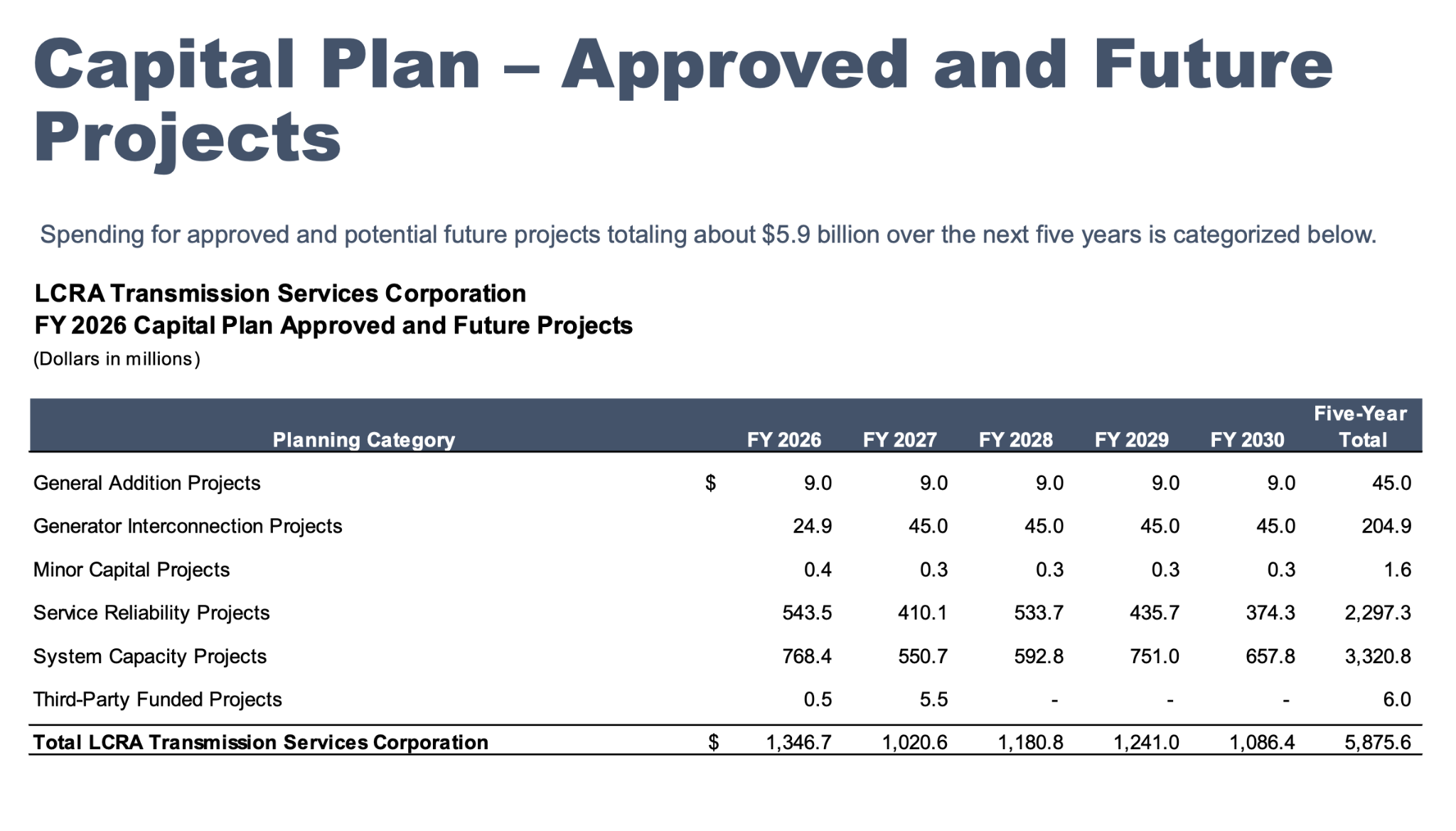

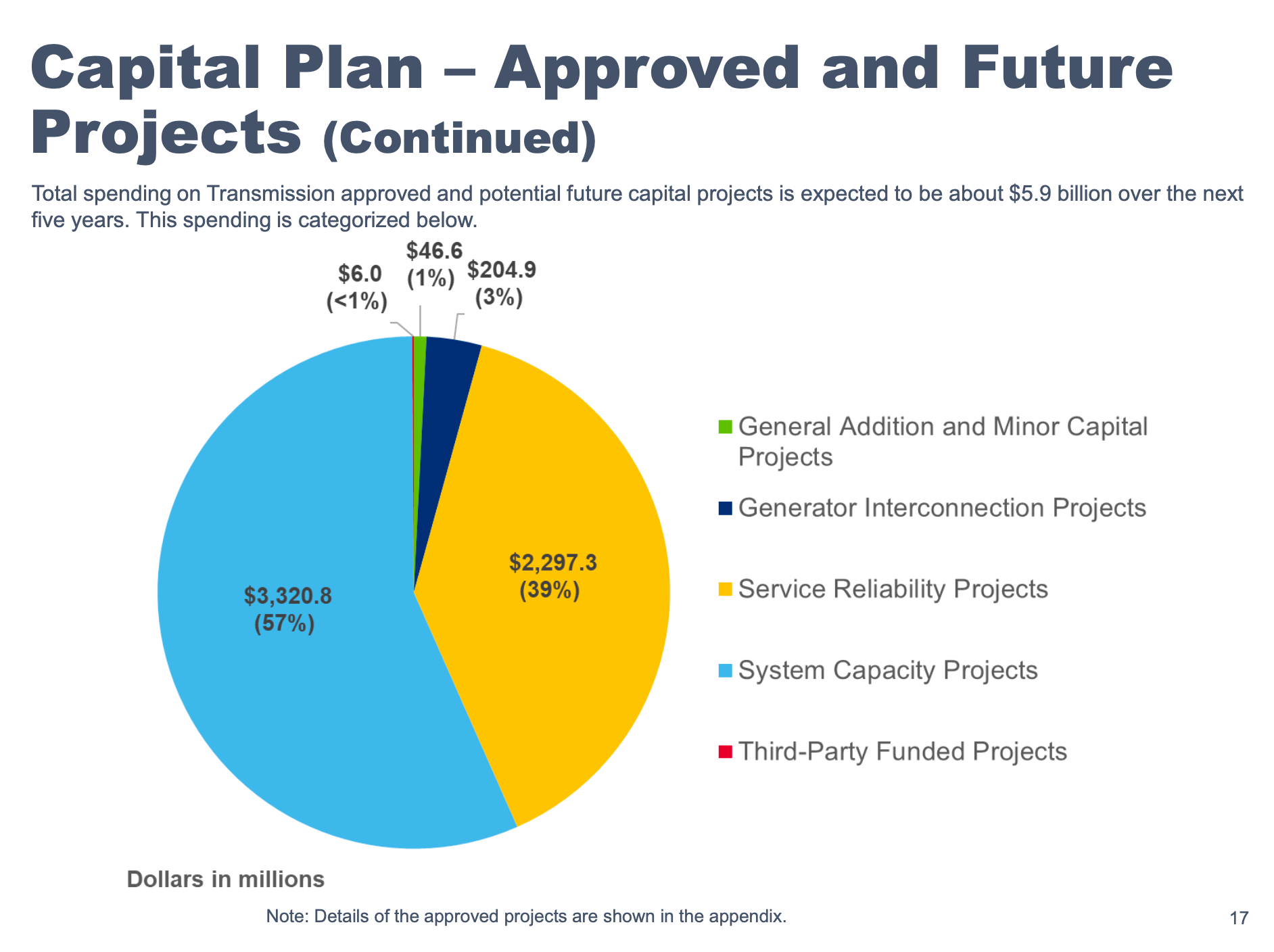

LCRA TSC plans to invest about $5.9 billion over the next five years to build new transmission facilities and improve existing ones. LCRA TSC will undertake numerous projects to increase reliability, meet existing and projected needs for electricity, and connect new electric generators to the state’s power grid. In addition, under authority from the Texas Legislature, LCRA is implementing new ways to help connect people to broadband services by using excess capacity in LCRA’s fiber infrastructure.

On the water side, LCRA is taking significant actions to conserve and extend the region’s water supplies, as well as developing new regional water supply projects. LCRA’s biggest project underway is the Arbuckle Reservoir in Wharton County, the first significant new water supply reservoir in the lower Colorado River basin in decades and the first water storage facility LCRA has downstream of the Highland Lakes. Arbuckle is expected to be online later this year.

LCRA plans to invest about $159.5 million over the next five years for the development of new water supply projects and will invest about $44.4 million in dam rehabilitation projects – excluding projects strictly for hydroelectric power facilities – over the next five years for the continued safe and effective operation of its dams.

“LCRA is continuing to make significant investments in all our areas of business, including power, water, broadband and transmission,” LCRA General Manager Phil Wilson said. “These investments align with our mission and vision and demonstrate our commitment to finding strategic and innovative solutions to help meet the needs of current and future generations of Texans in our growing state.”

LCRA does not receive state appropriations or have the ability to levy taxes. LCRA is funded by the revenues its businesses generate.

LCRA’s 2026 fiscal year begins July 1. The FY 2026 LCRA business and capital plans are available at www.lcra.org/about/financial-highlights/business-plan/.

LCRA continues working to help meet state’s growing need for power and water

AUSTIN, Texas – The LCRA Board of Directors on Wednesday approved a business plan of about $577 million and authorized capital investments of about $1.32 billion for energy, water and public service projects to support Texas in fiscal year 2025.

The Lower Colorado River Authority is the primary wholesale provider of electricity in Central Texas and manages the lower Colorado River and six Highland Lakes. LCRA Transmission Services Corporation is one of the largest electric transmission service providers in Texas.

“Our business and capital plans uphold LCRA’s commitment to invest in Texas’ future by helping to build the power, water and communications infrastructure critical for our state’s continued success,” said Timothy Timmerman, chair of the LCRA Board of Directors. “LCRA’s investments support a growing region in Texas and supply the services essential for maintaining healthy economies and businesses within our communities and our state.”

As one of the largest public power providers in the state, LCRA provides power for electric cooperatives and small towns in Central Texas by selling wholesale electricity through long-term contracts with retail utilities.

One of LCRA’s largest capital projects is a new two-unit peaker power plant under construction in Caldwell County. The new natural gas-fired Timmerman Power Plant, named after the chair of the LCRA Board of Directors, will help meet the state’s increasing need for reliable power and support the Texas energy grid by providing dispatchable power when demand approaches or surpasses the amount of power available from other sources.

Each of the plant’s two units will be able to supply up to 190 megawatts of dispatchable power. When operating at full capacity, the Timmerman plant will be able to supply enough electricity to power more than 100,000 homes during periods of peak demand. The first unit is expected to be operational in 2025, and the second unit is scheduled to come online in 2026.

This year marks LCRA’s 90th anniversary. In 1934, Gov. Miriam A. “Ma” Ferguson signed legislation creating LCRA to improve the quality of life of people living in a region challenged by floods, droughts and limited access to electricity.

“We electrified the Hill Country in the 1930s and ’40s, and now we are taking a lead role in investing in dispatchable generation that can be called upon quickly when needed,” LCRA General Manager Phil Wilson said. “We are well positioned to serve Texans and our customers for many years to come because while LCRA’s services have evolved over the past 90 years, we continue to help Texans respond to significant population growth by staying true to our mission to enhance the quality of life of the people we serve through water stewardship, energy and community service.”

LCRA TSC plans to invest more than $3.9 billion over the next five years to build new transmission facilities and improve existing ones. LCRA TSC will undertake numerous projects to increase reliability, meet existing and projected needs for electricity, and connect new electric generators to the grid.

LCRA is working to enhance the information age in its Texas service area, investing about $146 million over the next five years to greatly increase the amount of data that can be sent over LCRA’s radio system to facilitate smart technologies. LCRA also is using its fiber capacity as the middle mile – the highway to which last-mile providers can connect – to help provide broadband services that are essential to the continued success of communities in the region.

Additionally, LCRA continues to make investments to increase regional water supplies. LCRA is completing the new Arbuckle Reservoir and plans to invest about $174 million over the next five years for other new water supply projects. LCRA also will continue to maintain and invest in its system of dams, which are critical to protect water supplies and provide flood management, and will invest more than $38 million in rehabilitation projects over the next five years to help ensure the dams continue to operate safely.

LCRA does not receive state appropriations or have the ability to levy taxes. LCRA is funded by the revenues its businesses generate.

The LCRA 2025 fiscal year begins July 1. The FY 2025 LCRA business and capital plans are available at www.lcra.org/about/financial-highlights/business-plan/.

On January 18, 2023, the Board of Directors of the LCRA Transmission Services Corporation (the “Corporation”) and the Board of Directors of the Lower Colorado River Authority (“LCRA”) adopted resolutions delegating the authority to an authorized representative of LCRA to approve the issuance of one or more series of bonds as Transmission Contract Debt (as defined below) in a maximum aggregate principal amount not to exceed $950 million for the purposes of (i) refunding certain outstanding Transmission Contract Debt, (ii) funding a debt service reserve fund for any such bonds and/or (iii) paying costs of issuance for any such bonds. Pursuant to such authority, on March 2, 2023, LCRA issued its Transmission Contract Refunding Revenue Bonds (LCRA Transmission Services Corporation Project), Series 2023 in the aggregate principal amount of $365,045,000.

LCRA currently contemplates utilizing such remaining authority to price a series of fixed rate bonds (the “Proposed Bonds”) in a principal amount of approximately $481.5 million* as early as May 8, 2023* through a negotiated sale to a syndicate of underwriters led by J.P. Morgan Securities LLC as senior manager.

The Proposed Bonds as Transmission Contract Debt would be secured by a lien on and pledge of certain Installment Payments (as defined below) payable to LCRA from the Corporation pursuant to an amended and restated Transmission Contract Revenue Debt Installment Payment Agreement, dated as of March 1, 2003 as supplemented by a Transmission Contract Revenue Debt Installment Payment Agreement Supplement Relating to the Proposed Bonds, currently anticipated to be dated as of May 1, 2023.

The size, timing, and structure of the potential transaction for the Proposed Bonds is subject to market conditions. LCRA reserves the right to change the timing and size of the sale or not to issue the Proposed Bonds.

Capitalized terms used in this notice and not otherwise defined herein shall have the meanings ascribed to them in the Official Statement, dated February 15, 2023, relating to the Lower Colorado River Authority Transmission Contract Refunding Revenue Bonds (LCRA Transmission Services Corporation Project), Series 2023 issued by LCRA on behalf of the Corporation.

Executive Team

Phil Wilson

Jim Travis

Kristian Koellner

FY2026 Transmission Projects

Talk to us

Have questions? Reach out to us directly.